Tag: insurance

Physician burnout

Physician burnout has been in the news for the past few years. Defined as a sense of physical and emotional collapse related to work stresses, symptoms include exhaustion, cynicism, feelings of incompetence and poor work performance. In a survey of 6,880 physicians in 2014, 54.4% reported at least 1 symptom of burnout (up from 45.5% in 2011) and the numbers are continuing to rise. A systematic review summarizing articles written about physician burnout suggests that burnout can also lead to an increase in medical errors. Among the suspected causes of burnout are the pressures of seeing more patients in less time, the challenges of documenting clinical visits in an electronic health record, increasing paperwork required by insurance companies, etc. In short, the demands of a fragmented, dysfunctional healthcare system are thought to be an important contributor to the suffering experienced by physicians.

Physician burnout has been in the news for the past few years. Defined as a sense of physical and emotional collapse related to work stresses, symptoms include exhaustion, cynicism, feelings of incompetence and poor work performance. In a survey of 6,880 physicians in 2014, 54.4% reported at least 1 symptom of burnout (up from 45.5% in 2011) and the numbers are continuing to rise. A systematic review summarizing articles written about physician burnout suggests that burnout can also lead to an increase in medical errors. Among the suspected causes of burnout are the pressures of seeing more patients in less time, the challenges of documenting clinical visits in an electronic health record, increasing paperwork required by insurance companies, etc. In short, the demands of a fragmented, dysfunctional healthcare system are thought to be an important contributor to the suffering experienced by physicians.

Follow the money

A few days after my success getting insurance coverage for a 3-month supply of my daughter’s specialty medication, I learned that my husband’s employer was switching to a new specialty pharmacy. This meant that a new organization was now handling all the logistics of getting the drug to may daughter – the paper work, the shipping, collecting of co-pays, etc.

A few days after my success getting insurance coverage for a 3-month supply of my daughter’s specialty medication, I learned that my husband’s employer was switching to a new specialty pharmacy. This meant that a new organization was now handling all the logistics of getting the drug to may daughter – the paper work, the shipping, collecting of co-pays, etc.

While this was very frustrating news, it was not surprising. Specialty drug spending has increased dramatically in recent years. While there is no standard definition of specialty drugs, these are the high-priced drugs (> $600/month) that are often given by injection and are used to treat serious inflammatory conditions (like rheumatoid arthritis or Crohn’s disease), infections (like HIV and hepatitis C) and many types of cancer. These drugs are often amazing – they save lives and improve symptoms in people who would have suffered greatly in the past. Sadly, companies are competing to make money from these high-priced drugs.

It is easy to blame drug companies for the high price of specialty drugs but they are not the only ones who make money on these drugs.

Our insurance mess

A few months ago, I read the horrifying story in the New York Times written by a physician, Aaron Carroll entitled “Trapped in the System: A Sick Doctor’s Story”, about how difficult it was for him to get his prescription filled. At the time I joked with my husband that the story didn’t sound that bad to me. My daughter has been taking “specialty drugs” (expensive drugs that are used to treat complicated medical problems like cancer, rheumatoid arthritis and multiple sclerosis) for several years and we have had many frustrating experiences, especially trying to figure out the medical bills. Her recent switch to a new specialty drug has caused the biggest problems yet.

A few months ago, I read the horrifying story in the New York Times written by a physician, Aaron Carroll entitled “Trapped in the System: A Sick Doctor’s Story”, about how difficult it was for him to get his prescription filled. At the time I joked with my husband that the story didn’t sound that bad to me. My daughter has been taking “specialty drugs” (expensive drugs that are used to treat complicated medical problems like cancer, rheumatoid arthritis and multiple sclerosis) for several years and we have had many frustrating experiences, especially trying to figure out the medical bills. Her recent switch to a new specialty drug has caused the biggest problems yet.

Most insurance plans use other companies, called pharmacy benefit managers or PBMs, to manage prescription drugs. And PBMs use companies called “specialty pharmacies” (often owned by them) to manage specialty drugs, which are a key factor in driving up healthcare costs.

Are we in Belarus?

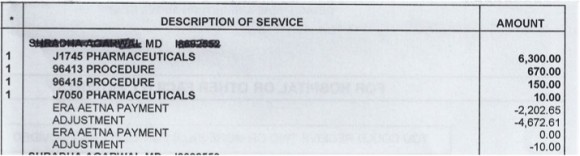

I spent much of last week trying to sort out the bills for the medication my daughter receives by infusion every 2 months. I’ve written before about the facility fees that many hospitals charge patients to inflate their bills and about how hospital bills are impossible for patients to understand. Because the facility fees doubled our out-of-pocket expenses, we applied to a program run by the pharmaceutical company, that reimburses patients for up to $6000 per year for drug costs.

I spent much of last week trying to sort out the bills for the medication my daughter receives by infusion every 2 months. I’ve written before about the facility fees that many hospitals charge patients to inflate their bills and about how hospital bills are impossible for patients to understand. Because the facility fees doubled our out-of-pocket expenses, we applied to a program run by the pharmaceutical company, that reimburses patients for up to $6000 per year for drug costs.

The drug company program requires that the patient send copies of the Explanation of Benefits (EOB) from the insurance company along with the bill from the hospital after each infusion. Unfortunately, neither the insurance company nor the hospital includes the name of the drug in their paperwork so the reimbursement was denied by the drug company. After many attempts I was able to get an itemized bill from the hospital (although they made it clear that I would have to call each time I needed one in the future). The reimbursement for one infusion was finally issued – but it was put on a Mastercard that could only be used for payment of future infusions. After many weeks, I finally found a person in the infusion center who agreed to help me figure out how to spend the money that was already on the Mastercard.

Patient centered billing

My husband and I returned from a weekend away to find a message on our answering machine saying that we owed money to the hospital and that if we didn’t pay it within 10 days, they would send the bill to a collection agency. The message was left on Saturday night and the automated voice said the charges were for cardiology services for our daughter.

My husband and I returned from a weekend away to find a message on our answering machine saying that we owed money to the hospital and that if we didn’t pay it within 10 days, they would send the bill to a collection agency. The message was left on Saturday night and the automated voice said the charges were for cardiology services for our daughter.

Our initial thought was that this was a mistake because: 1) our daughter had not been seen by a cardiologist and 2) we have paid all our bills.